Our story

Our story

Heartland is a listed Australasian banking and financial services group, comprising two banks – Heartland Bank and Heartland Bank Australia. Both banks focus on providing specialist banking products that enable better lives for New Zealanders and Australians. These include Reverse Mortgages, Livestock Finance, and Savings and Deposits in both countries, with Motor Finance and Asset Finance offered in New Zealand.

Heartland’s role as the listed parent company is to ensure capital is allocated to the parts of its business which generate strong returns, and to set the strategy and risk appetite within which the group operates. This enables Heartland to maximise shareholder returns, and for each bank to enhance the value it offers customers by helping more New Zealanders and Australians with their specialist banking needs.

Heartland Bank NZ

Heartland Bank AU

Celebrating 150 years of Heartland

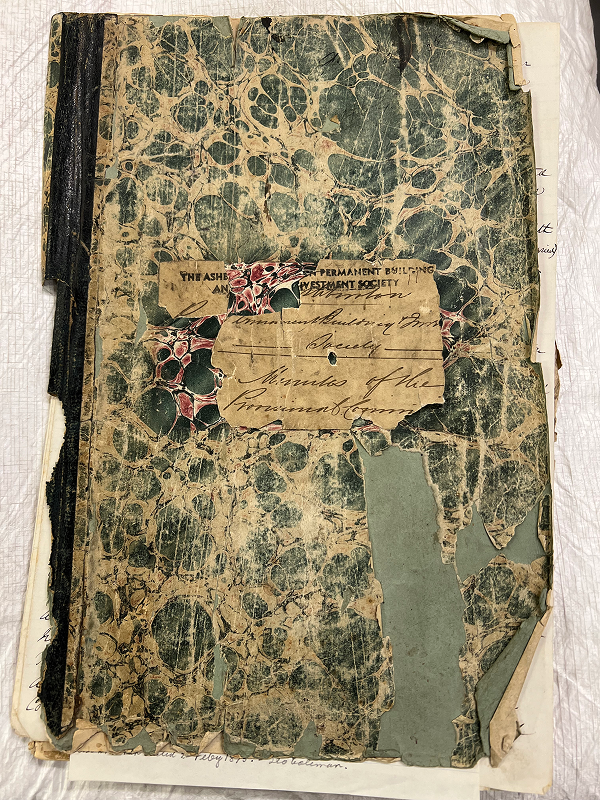

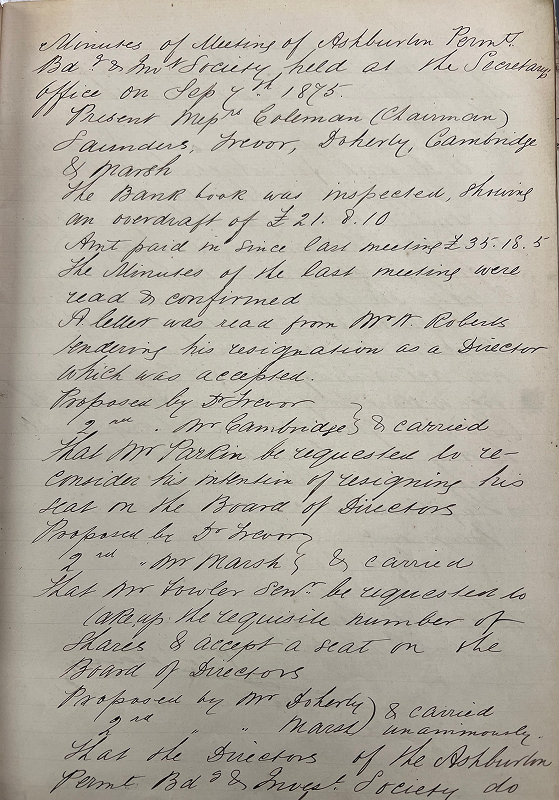

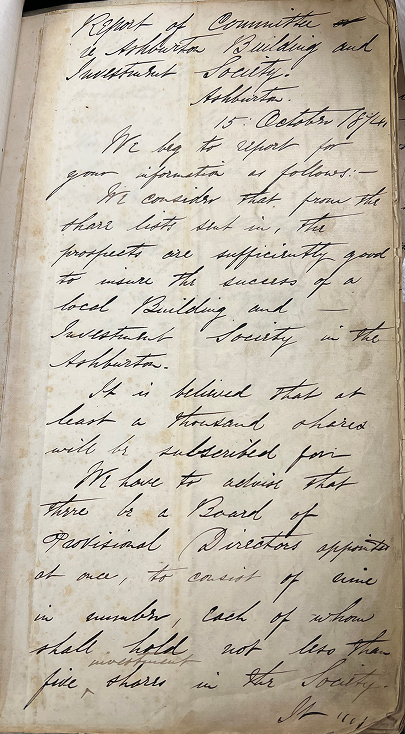

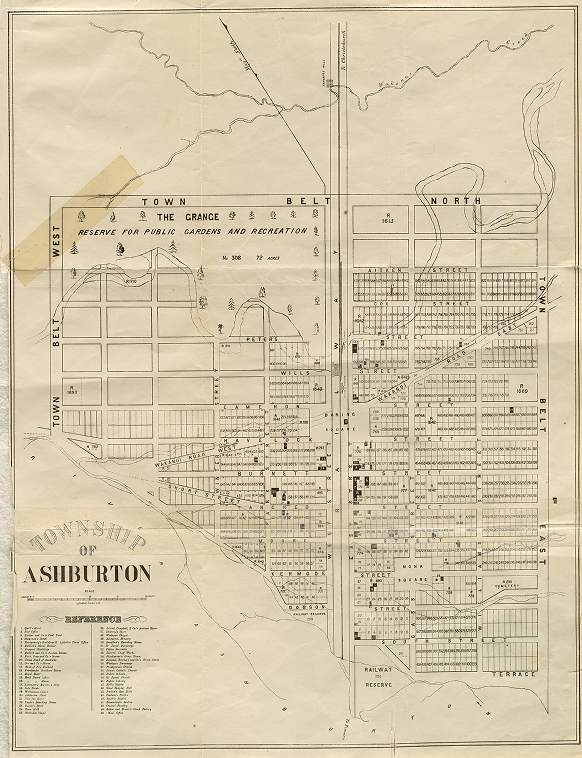

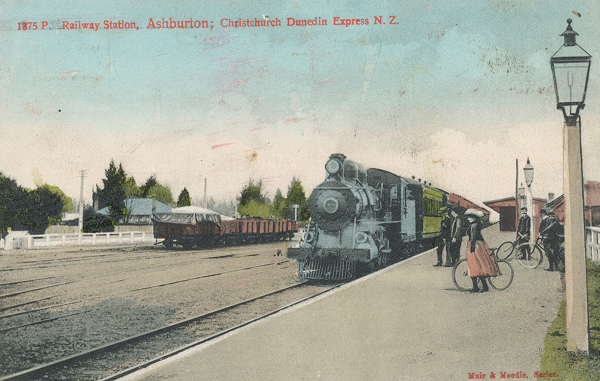

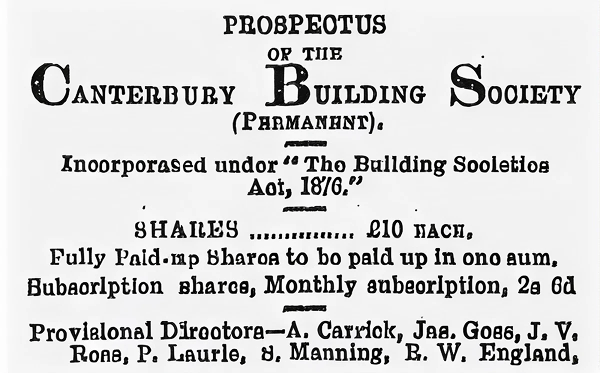

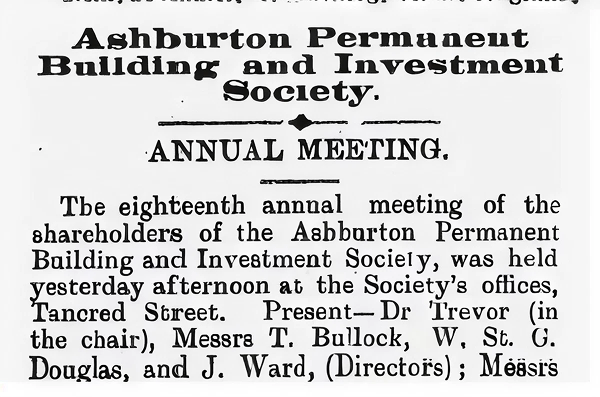

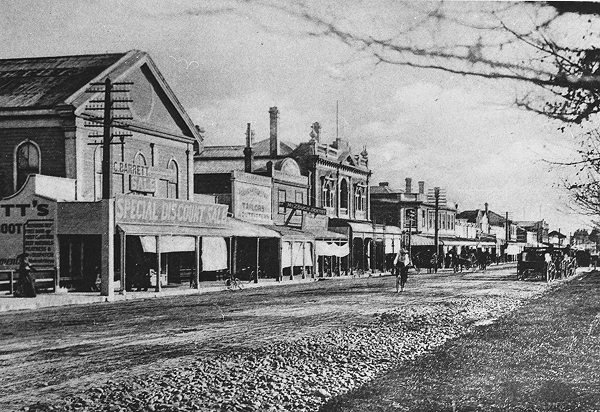

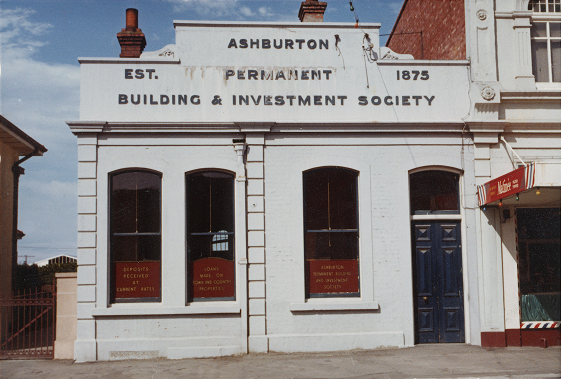

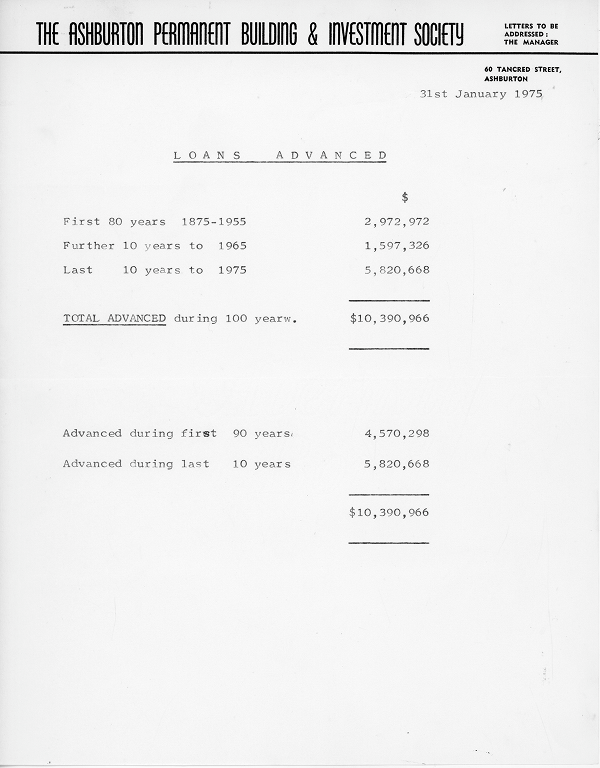

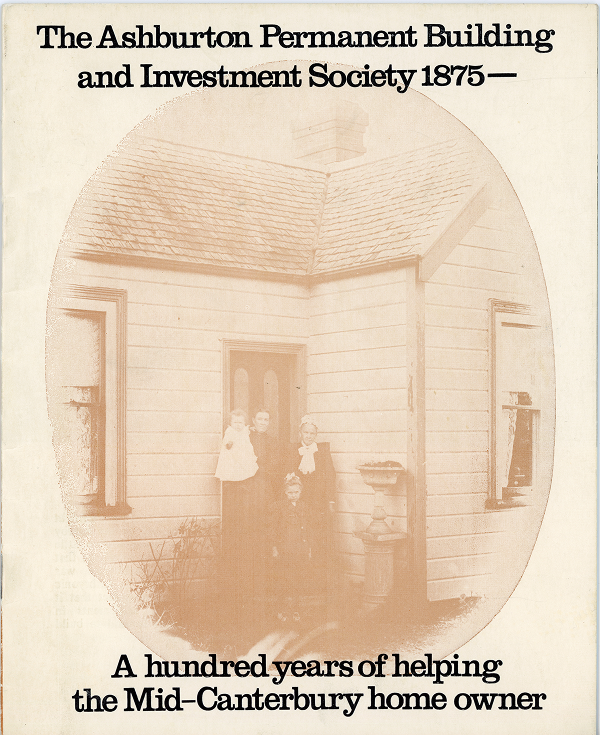

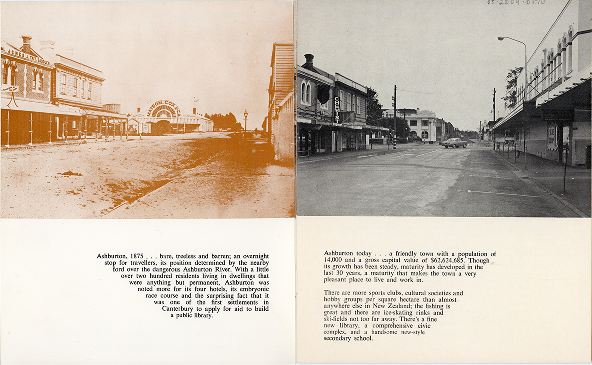

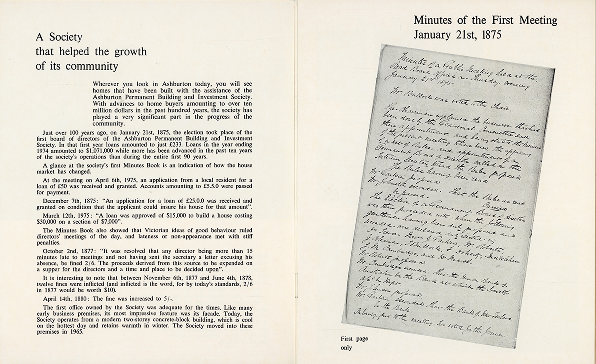

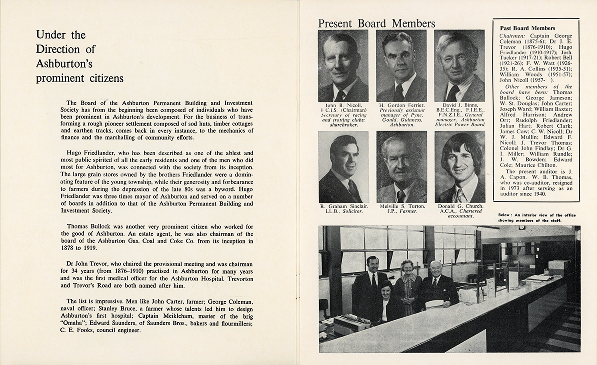

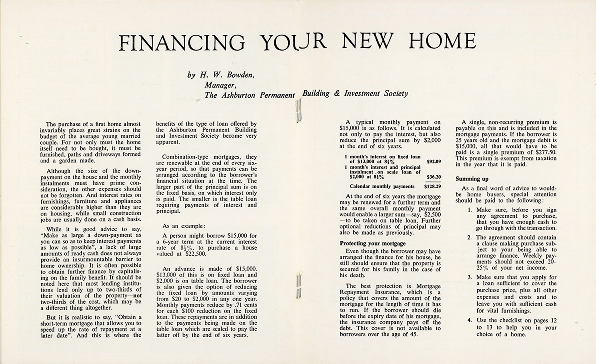

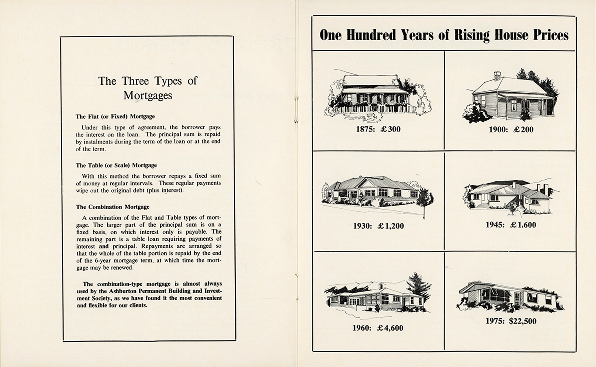

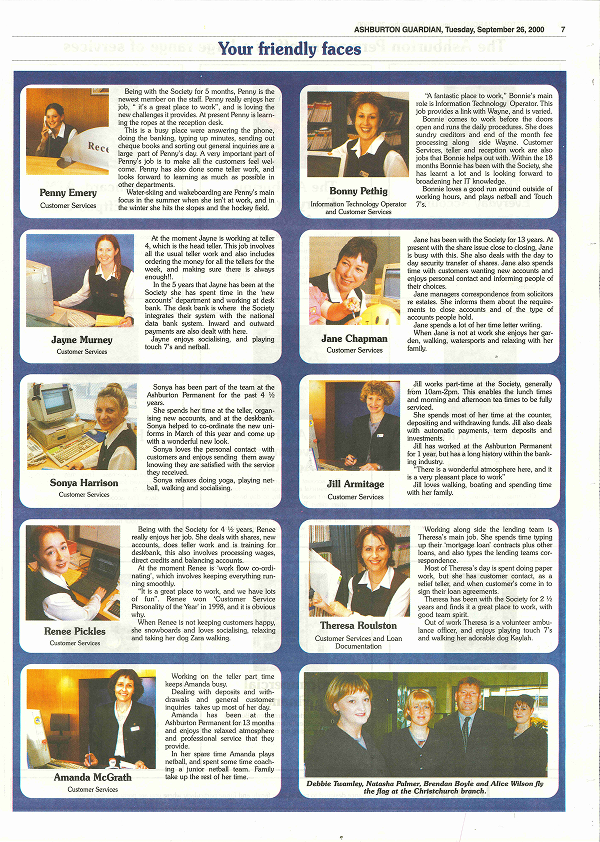

Heartland’s current form is the result of a series of mergers and acquisitions – and while we may have officially formed in 2011 – our heritage can be traced to the establishment of the Ashburton Permanent Building & Investment Society, which opened its doors in 1875.

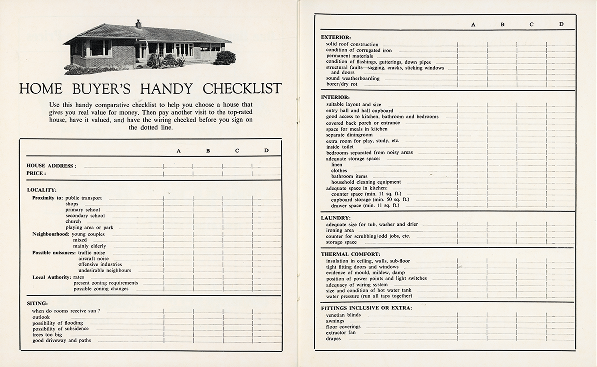

To celebrate our 150-year milestone, a short film and commemorate book were created to serve as a recollection of how Heartland came to be and who we are today.

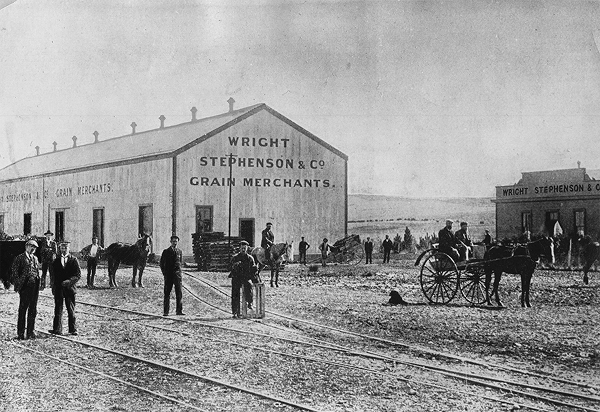

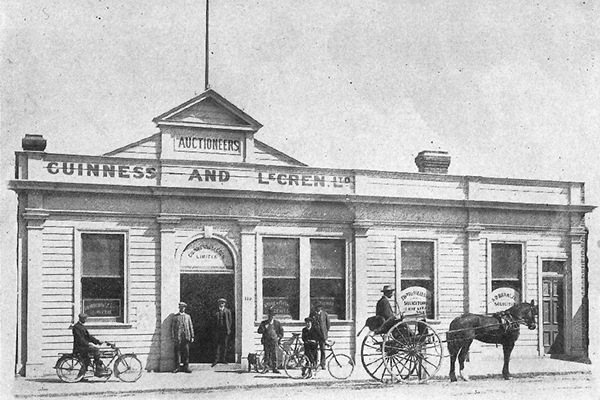

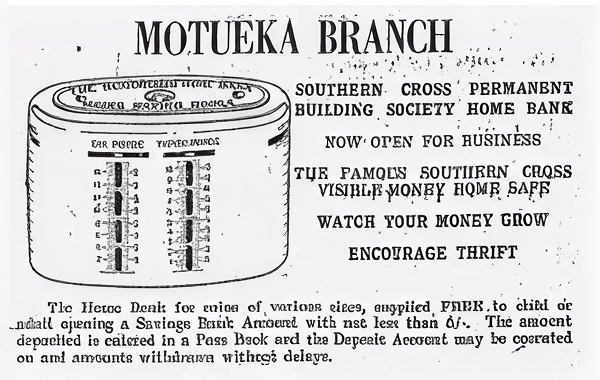

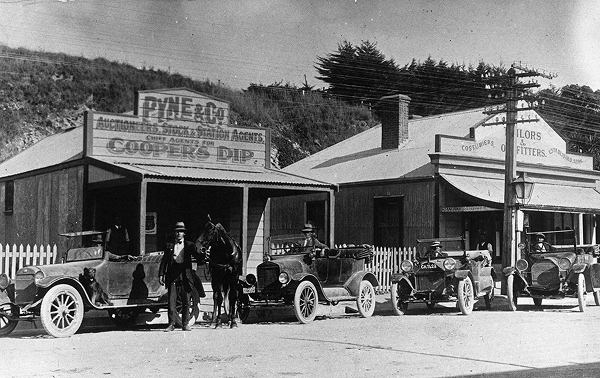

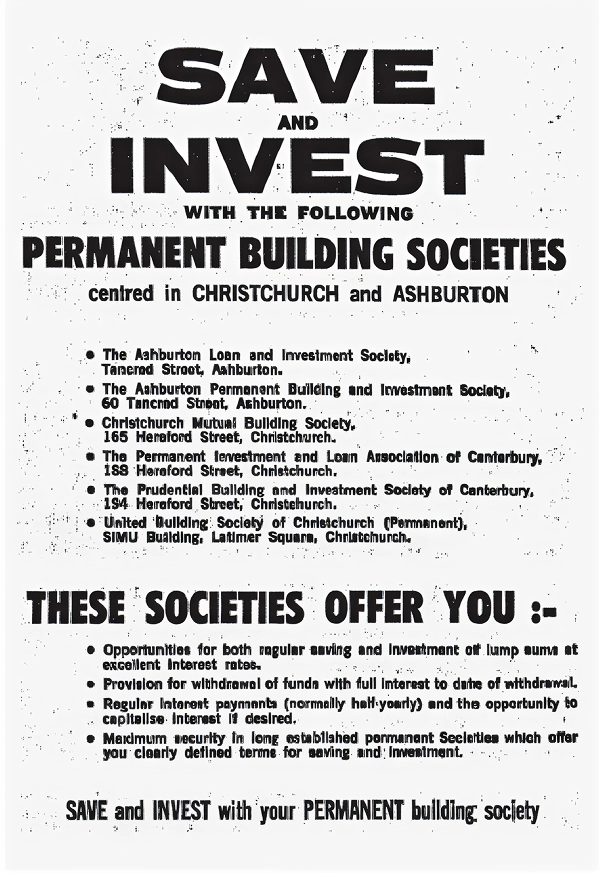

Beginning in 1875 with the Ashburton Permanent Building & Investment Society, the organisation evolved through successive mergers, first with SMC Building Society and Loan & Building Society to form Canterbury Building Society in 2008, and then with Pyne Gould Corporation’s Marac Finance, Southern Cross Building Society and PGG Wrightson Finance to establish Heartland in 2011.

In 2014, Heartland’s acquisition of the reverse mortgage businesses from Sentinel and Australian Seniors Finance marked the beginning of our trans-Tasman footprint. This grew with the acquisition of StockCo Australia in 2022 and, most recently, Challenger Bank in 2024, now known as Heartland Bank Australia – making Heartland Bank the first New Zealand bank to acquire an Australian bank.

In its first year, the Ashburton Permanent Building & Investment Society recorded just £233 in mortgage lending. At the end of the 2025 financial year, Heartland’s lending totalled $7.16 billion – spanning household, rural and commercial loans across New Zealand and Australia. By 2025, Heartland was supported by more than 13,000 shareholders and a team of around 600 people servicing over 185,000 customers.

Our timeline

(scroll with your finger and touch the dates to reveal details)